SEPA 3.7 is coming: What you should do now!

Everything about the new SEPA standard at a glance

The new SEPA standard 3.7 will come into force on March 17, 2024, bringing with it significant changes for payment transactions within the EU. This also means that the previous SEPA standard 3.6 will no longer be accepted next year.

To avoid being left out in the cold on the deadline, you should act now and change your processes early. We will show you briefly and concisely what will change with SEPA 3.7 and how you can prepare to ensure smooth payment transactions without interruption.

In a nutshell: What do you need to know about SEPA 3.7?

To use SEPA 3.7, you must ensure the following:

- All address data must be available in a structured form.

- Your payment software must support the new format.

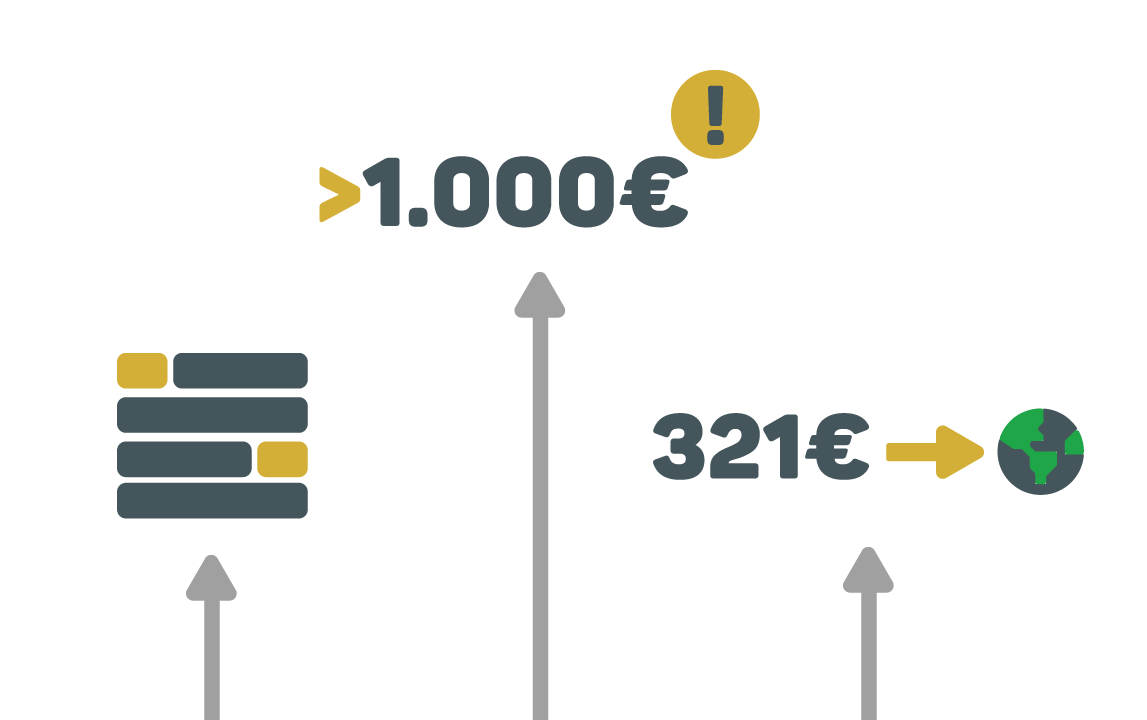

- For transfers to other EU countries over €1000, both the sender's and the recipient's address must be given.

What will change with SEPA 3.7?

SEPA 3.7 updates the formats for credit transfers and direct debits. These new formats are specified under the names pain.001.001.09 for SEPA credit transfers and real-time payments and pain.008.001.08 for SEPA direct debits. But what do the new formats mean?

One of the most important changes is the introduction of structured address data. This means that address data must now be entered in specific fields (e.g. separate fields for house number and zip code) instead of in two free text fields plus country code as before.

In addition, for transfers to other EU countries over €1000, both the sender's and the recipient's address must be provided in order to comply with the requirements of the Money Laundering Act. This serves to improve traceability and combat money laundering activities.

Another important point is the support of foreign payment transactions. The new SEPA format makes it possible to make transfers to other EU countries easier and more efficient. This extension is particularly relevant for companies that frequently make cross-border payments.

Why is the change relevant for me?

These changes are not only relevant for banks and financial institutions, but also affect companies, associations and private individuals who regularly make SEPA payments.

For example, if you are using older software to process SEPA payments that is not compatible with SEPA 3.7, you may experience difficulties in processing your transactions.

The new requirements for structured address data will increase accuracy and security in payment transactions. However, this also means that you need to ensure that your software and systems are able to process these new data formats.

When is the deadline?

The current SEPA format 3.6 will expire in November 2025 - it will be replaced by SEPA 3.7, which can already be used now. However, the old standard for international payments (DTAZV) is still permitted until November 2026.

Although there is still some time, we recommend acting as early as possible to avoid possible disruptions.

And it's worth it: you can already use the new standard to make payments to dozens of other EU countries under the uniform umbrella of the SEPA standard.

Which payment solution already supports SEPA 3.7?

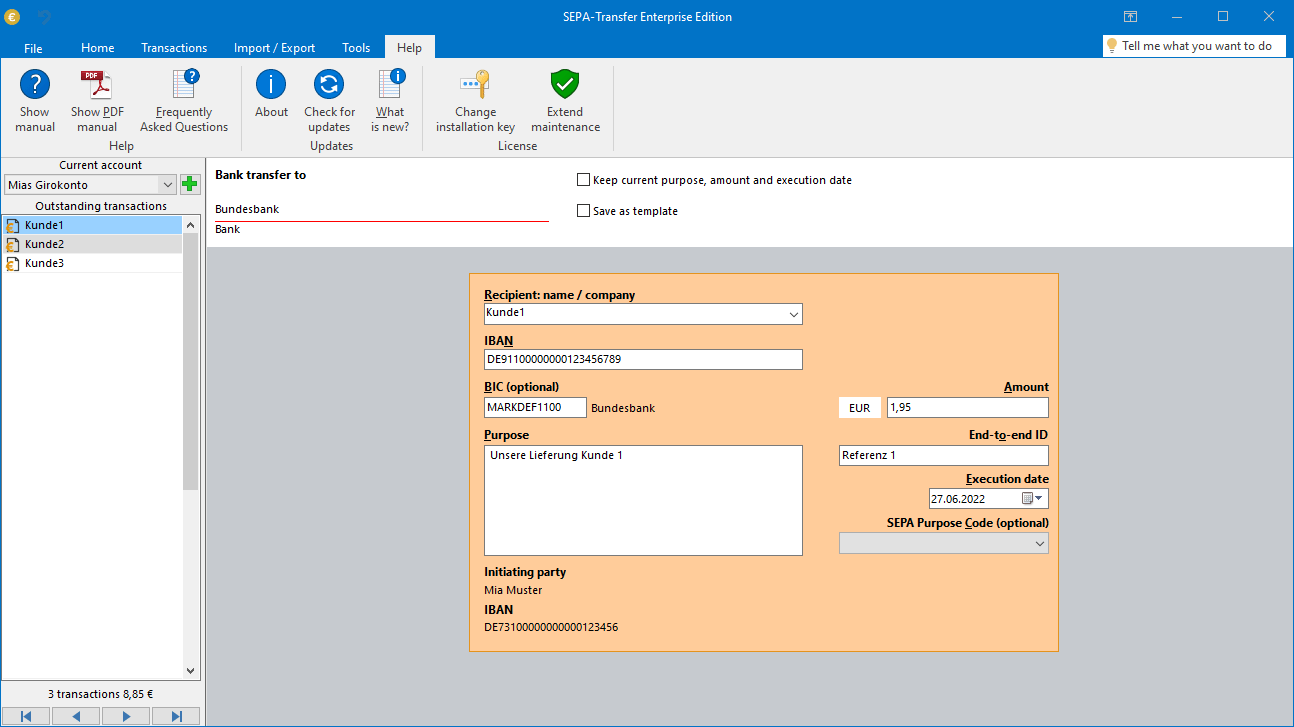

SEPA Transfer is a proven solution for processing large volumes of SEPA payments and direct debits that supports both the new SEPA format and the conversion of older versions.

This means you can continue to use your existing systems with SEPA Transfer without having to forego the new standard.

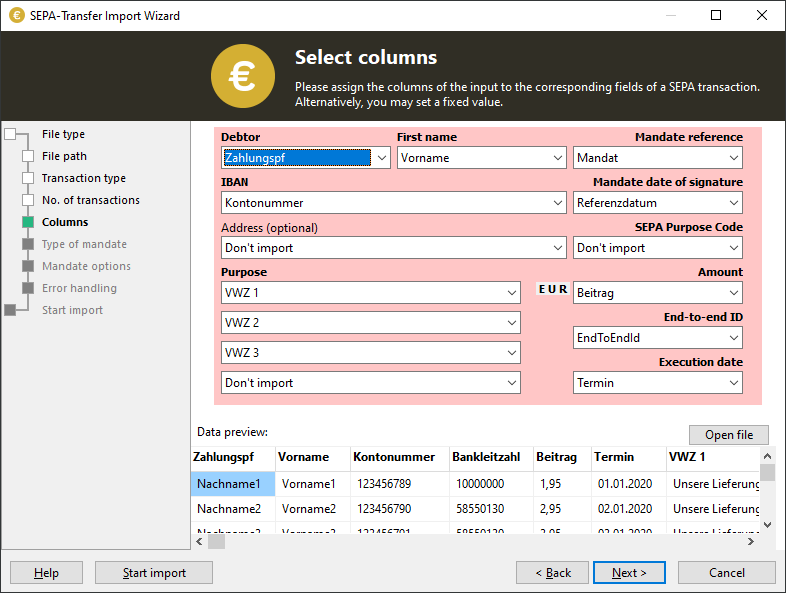

You can also use SEPA Transfer to convert data from Excel, Access, CSV and SQL databases into the new format, which offers you flexibility and security and saves you a lot of work.

Test SEPA Transfer now free of charge and without obligation before you decide.

What are the next steps?

In this article, we have provided you with comprehensive information about the upcoming changes to SEPA payments and possible options for action.

Now it's your turn: prepare for the changeover in good time by updating your software and ensuring that your data meets the new requirements. This will enable you to guarantee smooth payment transactions and prevent potential problems.

If one of your existing systems is not compatible with the new standard, you can use the latest version of SEPA Transfer to automate the changeover and thus minimize the effort involved.

You no longer have access to updates and support? No problem, extend your license at low cost in our customer area. If you have any further questions, please do not hesitate to contact us!