What is a SEPA Mandate?

You need a SEPA mandate to collect a SEPA direct debit. By signing the SEPA direct debit, the payer confirms that you are allowed to debit his account.

A SEPA direct debit mandate contains, inter alia, the following information:

- Creditor ID (provided by your bank)

- Unique mandate reference

Example:

Municipal utilities collect the discounts for electricity costs by direct debit. To do this, the administration requires written permission from their customers. This is the SEPA mandate. On this mandate, the direct debit for the monthly electricity bill and the debit date (e.g. on the 15th of each month) are agreed.

Mandate Variants

A basic distinction is made between single mandates and multiple mandates:

- A single mandate, also known as a single debit memo, is only valid for one transaction. This can be a one-time payment for goods, for example. If it is not used within 36 months of being issued, it is regarded as expired.

- A multiple mandate is valid until it is revoked. Here, too, the mandate must be used within 36 months of being granted, otherwise it expires. The multiple mandate can be used for large number of SEPA direct debits.

In addition, a distinction is made between basic direct debits and company direct debits. A company direct debit is designed for payment transactions between companies and may therefore only be used in the B2B area. The basic direct debit, on the other hand, is used for payment transactions between companies and private consumers.

How can SEPA-Transfer backup your process?

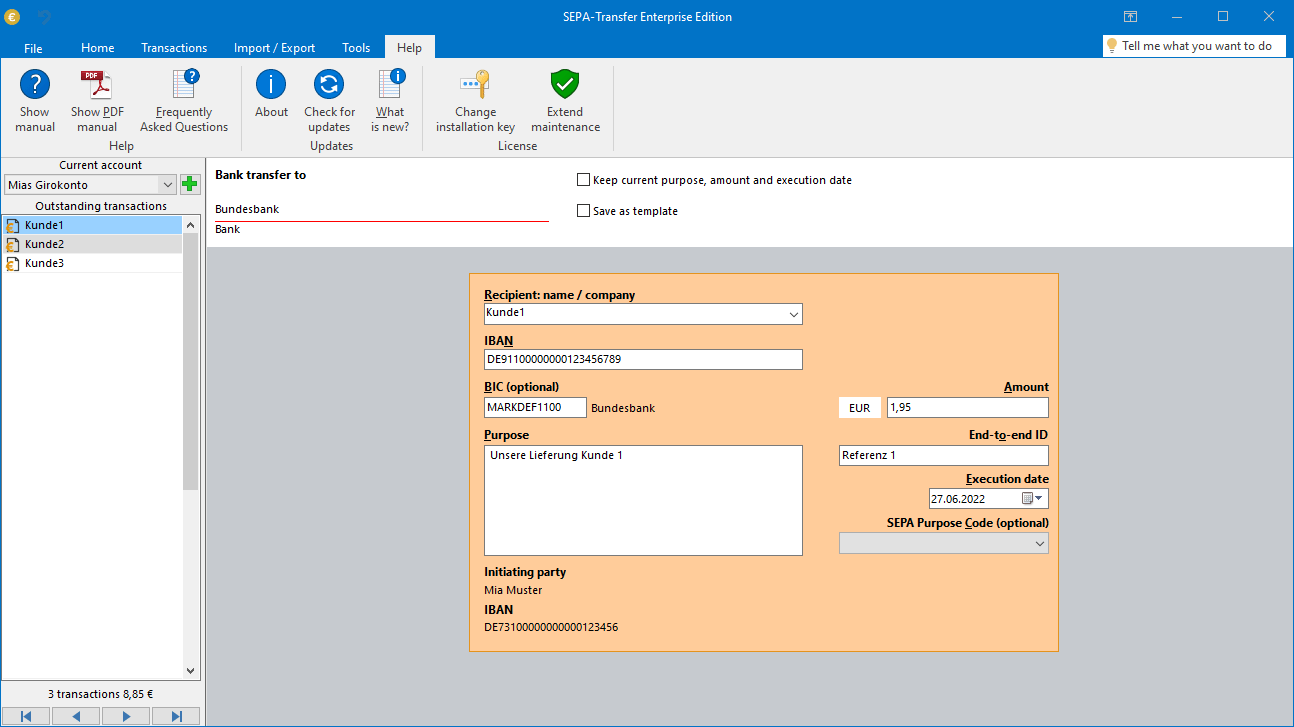

Whether for SEPA direct debits, recurring collective payments or printing a SEPA mandate: SEPA mandates have many different application scenarios. But in order for work processes to become truly agile, an efficient and easy-to-understand tool is needed.

With SEPA-Transfer, our goal is to provide banking software that is tailored to the main use cases of SEPA payments. SEPA-Transfer remains streamlined, user-friendly and, above all, cost-effective.

These are the most popular use scenarios of SEPA-Transfer:

Generate direct debits from SEPA mandates

A SEPA mandate is nothing more than the written permission of the payer to deduct amounts from his account. If, for example, the treasurer of a booster club wants to collect the annual funding amounts, he must first convert the mandate into a SEPA direct debit.

Our user-oriented tool SEPA-Transfer is designed exactly for this use case. In addition to the mandate reference, the payment data such as the name of the debtor, account number (IBAN), amount and also the reason for payment can be stored digitally. A convenient import from an Excel list is particularly suitable for this. If all payment data are digitally deposited, the treasurer can generate the corresponding direct debit mandate and print it. Alternatively, SEPA-Transfer also supports the digital forwarding of the direct debit to the bank.

Automize recurring payment tasks

SEPA mandates become particularly relevant when certain payments recur at regular intervals. For example, both membership fees and salaries are due monthly - especially in smaller companies and organizations, extensive and expensive banking software is not worthwhile for this, which is why the SEPA process is then carried out manually. But SEPA mandates can also be much more convenient.

A clever digital process provides a remedy: SEPA Transfer saves payments made so that they can be easily retrieved for the next payment. The important client reference, name, account details and amount are therefore automatically re-entered in the mask. Particularly practical for collective transactions.

We have automated our in-house canteen process with the help of SEPA-Transfer. We'll show you how we did it on our blog. Take a look!

Print SEPA mandates easily

SEPA-Transfer offers you ready-to-use print templates of all required forms. The forms contain data stored by you and become a completely filled out SEPA direct debit mandate with just one click. You can print this out ready for dispatch on any printer without any problems.

If you want to fill out the form by hand instead, you can use our SEPA direct debit form for free.

Try SEPA-Transfer for free

Are you looking for a tool for your SEPA payments?

SEPA-Transfer Small Business Edition